A client came to see me about a problem that is often occurring for a number of older Australians, how to leave their estate unevenly between their children and/or other people who have a claim on their estate. Whilst the starting position at law is that a person making a Will has what is known as ‘testamentary freedom’, that testamentary freedom is curtailed by the Succession Act. Section 41 of the Act allows a person who is a spouse, child (including adopted, adult and a step-child) or a person under the age of 18 years who is dependent on deceased person to make a claim known as a ‘Family Provision Application’ against the estate.

There is an old wives tale or urban legend that if you leave a beneficiary an amount varying from $20 to $1000 (and I’ve heard numbers from everywhere in between), the disappointed claimant cannot make a claim against your estate. That is simply not true. In reality, the only way to prevent a claim against your estate, is to either fortify the Supreme Court Registry with razor wire, which I do not recommend, or to divest yourself of assets.

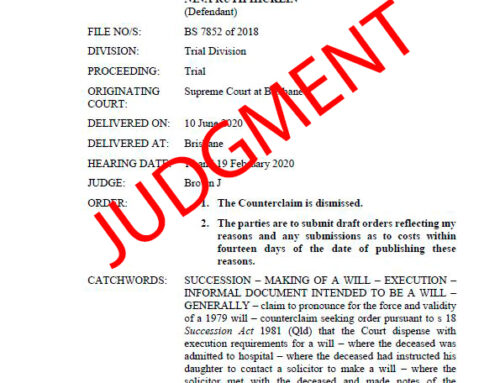

It is important to note that divesting yourself of assets in New South Wales or divesting yourself of New South Wales assets will not assist in your quest to prevent a claim against your estate. New South Wales has what is known as ‘notional estate regime to prevent the savvy Will maker from disinheriting the black sheep or lame duck of the family. In sunny Queensland however, an effective strategy can be put in place whereby a Will-maker can divest themselves of assets to a hybrid discretionary trust that is appropriately drafted to ensure that they retain the ultimate control of the trust assets, both capital and income during their lifetime, and that the benefits of that trust then cascade to their intended beneficiaries upon their demise. All of which takes place outside of the estate and outside of the clutches of s41 of the Succession Act.

There are of course stamp duty and capital gains tax issues that must be considered, in particular the loss of the capital gains tax-free status of your home (principle place of residence), and the stamp duty associated with transferring assets into the trust structure. The cost of transferring cash and other more liquid assets, such as shares (capital gains only) and cash (no capital gains tax and no stamp duty), can allow a path whereby what may be a certain claim against an estate, that could cost the intended beneficiaries in excess of $100,000 to do away with can be avoided for a fraction of that cost.

Until next time,

Dan Hutchinson

Disclaimer:

This is general legal advice only and is not intended to be relied upon by any party. We disclaim any loss or damage caused by reliance upon the general advice contained in this article. Your individual circumstances must be assessed prior to taking any action in relation to any matter discussed in any one of our articles or blog posts.